Sorbie works with Kogi Iron for up to $4.35m Investment

Kogi Iron Limited (ASX: KFE) (“Kogi”, “Kogi Iron” or the “Company”) and its 100% owned Nigerian operating company, KCM Mining Limited (“KCM”) are pleased to announce the following capital raisings:

- share placements to an institutional investor, and various professional and sophisticated investors (“Placement”) to raise $2.35 million; and

- share purchase plan to raise up to an additional $2 million (“SPP”)

Funds are to be used to progress the Bankable Feasibility Study for the Company’s 100% owned Agbaja Cast Steel Project (“Agbaja Project”), corporate costs and general working capital including the tenement holding costs of the Agbaja Project and Nigerian Community Development projects.

A proposal to prepare the Bankable Feasibility Study is expected in December 2019 and it is estimated the Study will take 12 months to finalise. Communication is continuing with 28 potential investors to raise the balance of the estimated $10m to be raised and Kogi is aiming to have this in place by the first quarter in 2020.

Managing Director of Kogi Iron Limited – David Turvey commented: “Personally, I’m very pleased with the structure of these cornerstone share placements that will support activities for an equity growth path by the Company. Importantly, these funds will assist Kogi Iron to build and promote the international profile of its “Project of National Significance” as publicly recognized by the Government at Nigeria Mining Week, October 2019”.

1. Placement

Kogi Iron has entered into agreements to place 68,409,091 fully paid ordinary shares. The shares will be issued under the Company’s existing 15% share placement capacity pursuant to ASX Listing Rule 7.1.

Sorbie

Sorbie Capital LP (“Sorbie”), an institutional investor, has subscribed for 56,818,182 new ordinary shares at a price of $0.0352 per share (the “Sorbie Subscription Shares”) for an aggregate consideration of $2,000,000 including an initial lump sum of $300,000 payable to Kogi on execution of the agreements. In addition, the Company has entered into a Sharing Agreement with Sorbie, which allows the Company to retain much of the economic interest in the Sorbie Subscription Shares. The Sharing Transaction will allow the Company to secure the potential upside on 37,735,849 of the Sorbie Subscription Shares arising from news flow over the next 18 months. Kogi entered into a similar financing arrangement with Lanstead (a party which shares a founder with Sorbie) in 2014.

The Sharing Transaction provides that the Company’s economic interest will be determined and payable in 18 monthly settlement tranches as measured against a Benchmark Price of $0.053 per share. If the measured share price exceeds the Benchmark Price, for that month, the Company will receive more than 100 per cent of the monthly settlement due. The measured share price is determined based on a VWAP for 20 trading days prior to the monthly settlement. There is no upper limit placed on the additional proceeds receivable by the Company as part of the monthly settlements. Should the share price be below the Benchmark Price, the Company will receive less than 100 per cent of the expected monthly settlement on a pro rata basis. In no case would a decline in the Company’s share price result in any increase in the number of ordinary shares to be issued to Sorbie or any other advantage accruing to Sorbie. The first of the eighteen monthly settlements will occur after an initial two-month grace period.

The Company will issue 2,840,909 new ordinary shares to Sorbie in consideration for the Sharing Transaction. All shares to be issued to Sorbie will rank pari passu with the existing shares on issue. Settlement of the Sorbie component of the Placement occurred on 20 November 2019. The Company will also be issuing in December 2019 2,982,955 new ordinary shares to the broker of the Sorbie transaction. The shares will be issued under the Company’s existing 15% share placement capacity pursuant to ASX Listing Rule 7.1.

The structure of this placing is designed to provide the Company with flexibility in continuing to advance the Agbaja Project while maintaining a constant source of funds covering a portion of the Company’s short to medium term cash flow requirements.

Professional and Sophisticated investors

The balance of the Placement (8,750,000 shares at 4 cents per share) will raise $0.35 million (before costs) and is to a variety of professional and sophisticated investors. The issue price represents a 19% discount to Kogi’s 20 day volume weighted average share price.

Settlement of the balance of the Placement will occur after the Record Date for the Share Purchase Plan.

2. Share Purchase Plan and apply for amounts in excess of $100k if you are a sophisticated investor

Kogi is pleased to provide the opportunity to existing shareholders to subscribe for additional shares in Kogi at 4.0 cents per share, to raise up to an additional $2 million. Shareholders whose registered address is in Australia or New Zealand as at the record date will be able to participate in the SPP for up to $30,000.

Shareholders wishing to subscribe for more than their allocation of $30,000 of shares in the SPP can participate in the placement to professional and sophisticated investors outlined above if they meet the required criteria. This will be completed by way of a placement of the SPP shortfall (if any). Eligible shareholders should contact Kevin Hart, Kogi’s Company Secretary, on 9316 9100 if they wish to apply for a minimum amount of $100,000 in the private placement.

The record date for the SPP is 5pm WST on 20 November 2019.

Full details of the SPP and a SPP offer document will be announced to the ASX and distributed to eligible shareholders shortly.

About Kogi Iron (ASX: KFE)

Kogi Iron Limited is a Perth-based company with the objective of becoming a producer of cast steel product that can be sold to manufacturers of steel products through the development of its 100% owned Agbaja Cast Steel project located in Kogi State, Republic of Nigeria, West Africa (“Agbaja” or “Agbaja Project”).

Nigeria has substantial domestic demand for steel products, which is currently met largely through imports. The Agbaja project, located on the Agbaja plateau approximately 15km northwest of Lokoja city in Kogi State and approximately 200km southwest of Abuja, the capital city of Nigeria, opens the opportunity for domestic production of steel billets.

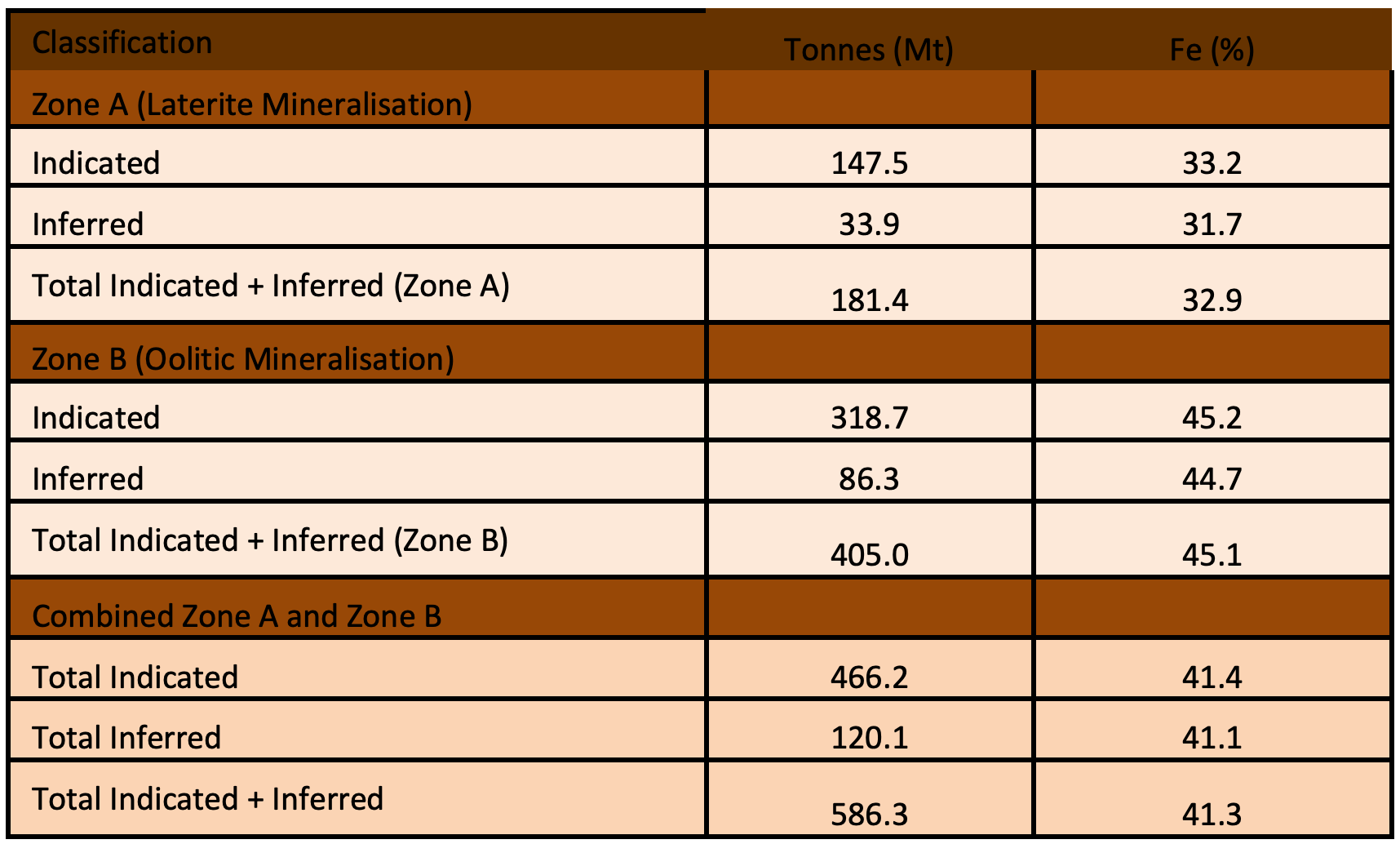

The Company holds a land position which covers a large part of the Agbaja Plateau. The Agbaja Plateau hosts an extensive, shallow, flat-lying channel iron deposit with an Indicated and Inferre Mineral Resource of 586 million tonnes with an in-situ iron grade of 41.3% reported in accordance with the JORC Code (2012). This mineral resource covers approximately 20% of the prospective plateau area within ML24606 and ML24607.

Table 1 – Summary Grade Tonnage for Laterite (Zone A) and Oolitic (Zone B) Horizons (20% Fe lower cut off is applied) Refer ASX announcement 10 December 2013.

The Company confirms that it is not aware of any information or data that materially affects the information included in the original market announcements and, in the case of estimated Mineral Resources, which all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements.