GME naked shorting in size is not happening right now.

It seems recently the idea that a naked short in GME of multiple 100s of millions of shares is being circulated on the internet. A naked short is selling the stock without having borrowed shares to make delivery to the buyer on settlement day. Naked short selling is illegal per SEC Regulation SHO. If a seller does not have shares at settlement, that is called a “fail to deliver.” Regulation SHO also requires an exchange to publish a list of securities where (1) the aggregate of fails to deliver is 10,000 shares or more, and (2) the level of fails is equal to at least 0.5% of issuer’s total outstanding shares. For GME, the 0.5% of outstanding would be about 348,500 shares. GME’s primary exchange is the NYSE.

The NYSE threshold list is https://www.nyse.com/regulation/threshold-securities and

NASDAQ’s is https://www.nasdaqtrader.com/trader.aspx?id=RegSHOThreshold

GME does not show on either list. So if there are any fails to deliver in GME as of 5 March, then the quantity is less than 348,500 shares. Average daily volume in GME in Feb/Mar is 41.4 million shares, so even if the fails to deliver are just under the 0.5% of outstanding, that would only be 0.84% of daily trading volume, and a buy-in of all possible fails to deliver is not going to have much of a price impact.

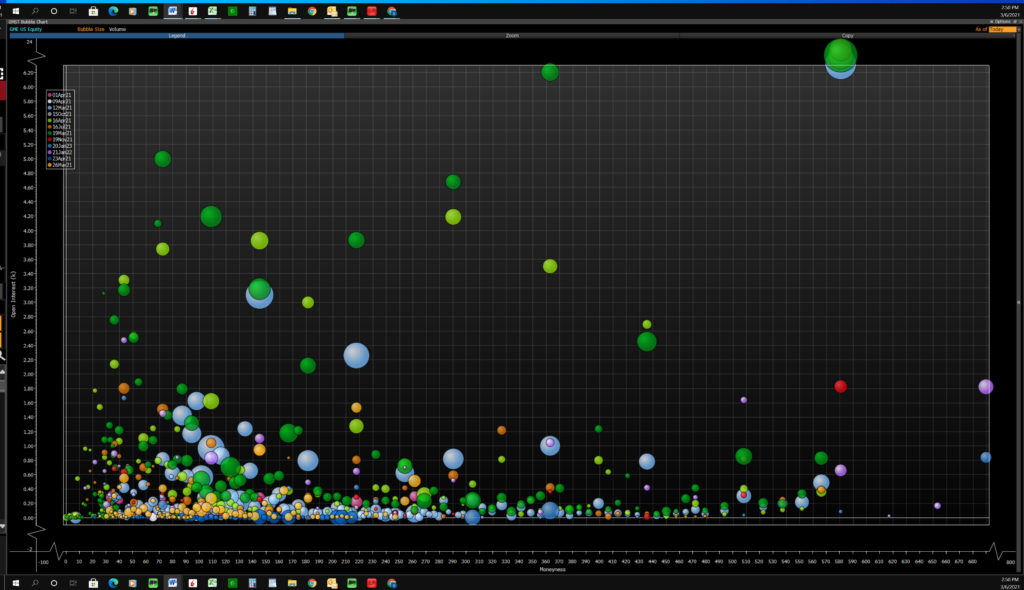

I have also seen some suggest that due to the in-the-money options that are about to be exercised in GME, this is equal to hundreds of millions of shares being short GME. The erroneous concept is that the option exercises will take the call writers short and force large buying to make good delivery on the shares to be delivered when the calls are exercised. First, current open interest of in-the-money call options in GME is 146,606 contracts. This equates to only 14,660,600 shares of a stock with an average daily trading volume of over 41 million shares. Secondly, not all of these calls will be exercised at the same time (see chart). If looked at by expiration date, assuming the stock is right where it is now, and assuming no contracts are closed out during the week, next Friday there will be 12,265 contracts exercised or 1,226,500 shares delivered through option exercise. March 19th 44,063 call option contracts would be exercised, and March 26th only 4,419 options contracts would be exercised.

Third, the concept ignores delta neutral hedging. Most options market makers try to run a matched book. This means that they dynamically hedge to eliminate market risk. If they sell a call option with a delta of 0.5, they will buy 50 shares at the same time. If the stock moves up and the delta goes to 0.6, they will buy 10 more shares. As they sell more call options, the market maker will buy more shares to stay delta neutral. If the market maker sells a put option, then they have to sell shares to delta hedge. It is possible to have a portfolio of written calls and puts that balance out to a delta of zero on the portfolio, thus requiring no current holding of the underlying stock. If the total 146,606 in-the-money call options in GME are delta hedged, then there are only 1.6 million shares that could potentially need to be purchased if all options are exercised. For the March expirations, if all the in-the-money call options have been delta neutral hedged, then the potential shares that would need to be purchased are: Mar 12th 228,500 shares, Mar 19th 445,500 shares, Mar 26th 55,900 shares. This ignores in-the-money puts that were sold and, when exercised, will bring in shares.

Do not buy GME based on a bad assumption that those who have sold GME call options need to buy 100s of millions of shares.

Each color illustrates an expiration date (see next)

DISCLAIMER: The information in this article is issued by Sorbie Bornholm for information only. It does not constitute a communication by Sorbie Bornholm, or any associate of Sorbie Bornholm, or an invitation or inducement to engage in an investment, nor is it a solicitation to buy or sell any investment or an agreement by Sorbie Bornholm to enter into any contract or agreement. See Terms of Use.